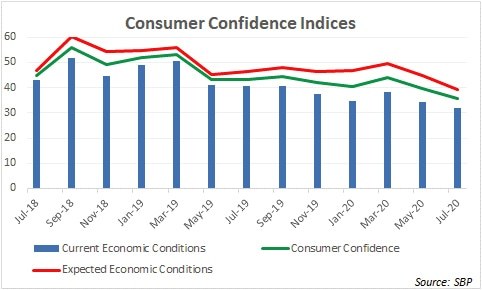

Coronavirus seems to have dented the consumer confidence to a great extent. Not since September 2012 has the consumer confidence been recorded lower than the latest July 2020 wave. Yes, the pandemic and the trouble it brought along has hastened the fall, but in the two years of the PTI government, consumer confidence has only thrice been in the positive zone (just about) in twelve survey waves.

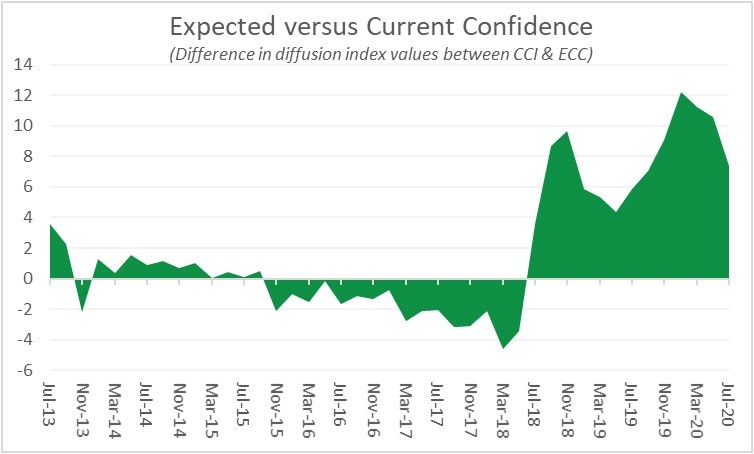

Looking at how consumers have responded over the years is an intriguing exercise in itself. Consumers have consistently responded with optimistic outlook for the next six months, as captured by the Expected Economic Conditions (EEC) diffusion index. Here, optimistic is in context with the response for the current conditions, even when in negative territory.

The EEC difference with Current Economic Conditions (CEC) presents an interesting reading. The PTI government in the two years has consistently received significantly optimistic responses on the next six months, despite mediocre responses on current and past performance.

The PML-N government, in contrast, had an almost zero-sum game, with average EEC score over five years, 1 percentage point lower than the CEC. And it was not as if the CEC score was very high in the positive territory either. The consumers still had better outlook for the next six months in the PML-N government for the first two months, and it was all downhill thereon.

The PTI clearly, somehow, wins more consumer confidence in the future, despite continuously underperforming. The average differential of 8 percentage points between EEC and CEC is no match to a miniscule difference that the PML-N era saw. Has the average Pakistani consumer suddenly turned more optimistic? How long will that last?

There may be substance in the argument that the popular support for the ruling party is there, and the people still believe that things can be turned around. It is the same people who had consistently negative views on the future six months, not so long ago, with similar sort of confidence in the present, despite much favorable indicators (such as GDP, inflation, employment, etc.)

This is also contrary to the popular perception that people are not patient with governments they elect. They gave two years to the previous government, showing hope in the future, albeit minimal – and it all went haywire from there on. PTI’s two years are almost done.

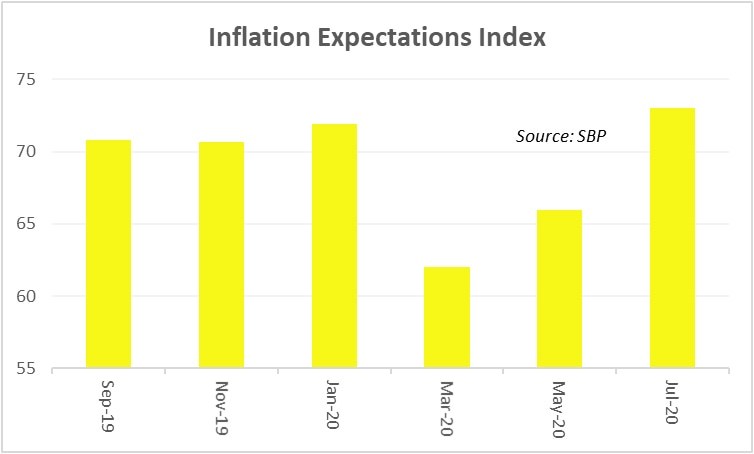

Another interesting bit is the consumers’ response to inflation -both past and future. An overwhelming majority of consumers will continue to have an unfavorable view over inflation, even when the recorded CPI numbers are showing massive retreat. Over the last eight years, consumers’ expectation on inflation has given a reading of 70 percent, which means more people are seeing prices higher in the next six months. The reading for past six months has been similar too. Maybe there is a need to frame the questions better as well.

How consumers’ confidence in the future shapes up will start unfolding soon. If the current performance does not pick, expect the differential to start narrowing. And if it doesn’t, then either the ruling party has a very strong support base ready to wait longer, or the survey design may need tinkering.

Comments

Comments are closed.